Where SA singles can still afford to buy

As featured in REA

Tom Bowden reports that nationally, less than 1 per cent of metropolitan suburbs are affordable for single people on an average salary.

Adelaide was the second worst city in the nation for dual-income househunters – and by a long way – with hopeful buyers only able to afford to buy in one in three suburbs.

Just 33 per cent of all suburbs, or 101, of them, could be bought by an average-earning couple without sending themselves into mortgage stress.

The report also found the cheapest homes for average couples were units in Salisbury, Salisbury East Paralowie and Klemzig, and Elizabeth North houses, where mortgage repayments needed were 18.8 per cent, 20.1 per cent, 20.1 per cent, 21.1 per cent and 21 per cent of an income respectively.

Compare The Market’s calculations assumed an average $65,000 income, a 20 per cent deposit, with repayments on the remaining loan paid at a 5.97 per cent interest rate.

It caps mortgage repayments at no more than 30 per cent of a household income.

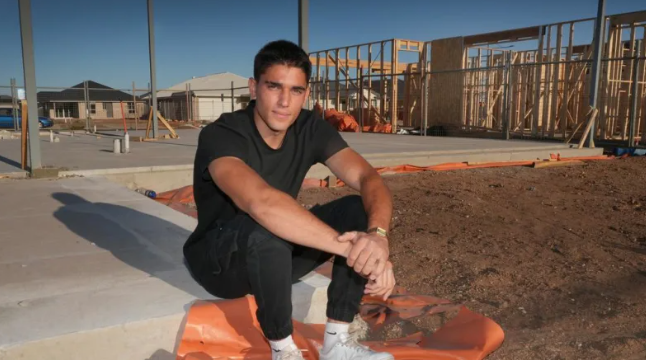

Floor tiler Vinnie Jurkovic, 21, last month bought a block he will build on at Riverlea.

Vinnie Jurkovic, 21, has managed to buy a property at the Riverlea development, north of Adelaide. Picture: Dean Martin

Vinnie Jurkovic, 21, has managed to buy a property at the Riverlea development, north of Adelaide. Picture: Dean Martin

After saving for about three years throughout his apprenticeship he said he was excited to have a place he will one day call his own home.

“I used to live in Virginia so I wanted to move back into the area,” he said.

“It’s not easy for a single person, but if you have help from your parents, in that you’re living at home and you don’t have expenses then it makes it easier.

“Getting the loan was the hardest part, with the three month saving plan. You just have to be on your bare minimum of costs for three months to show you can afford the property.

“An interest rate will definitely help.”